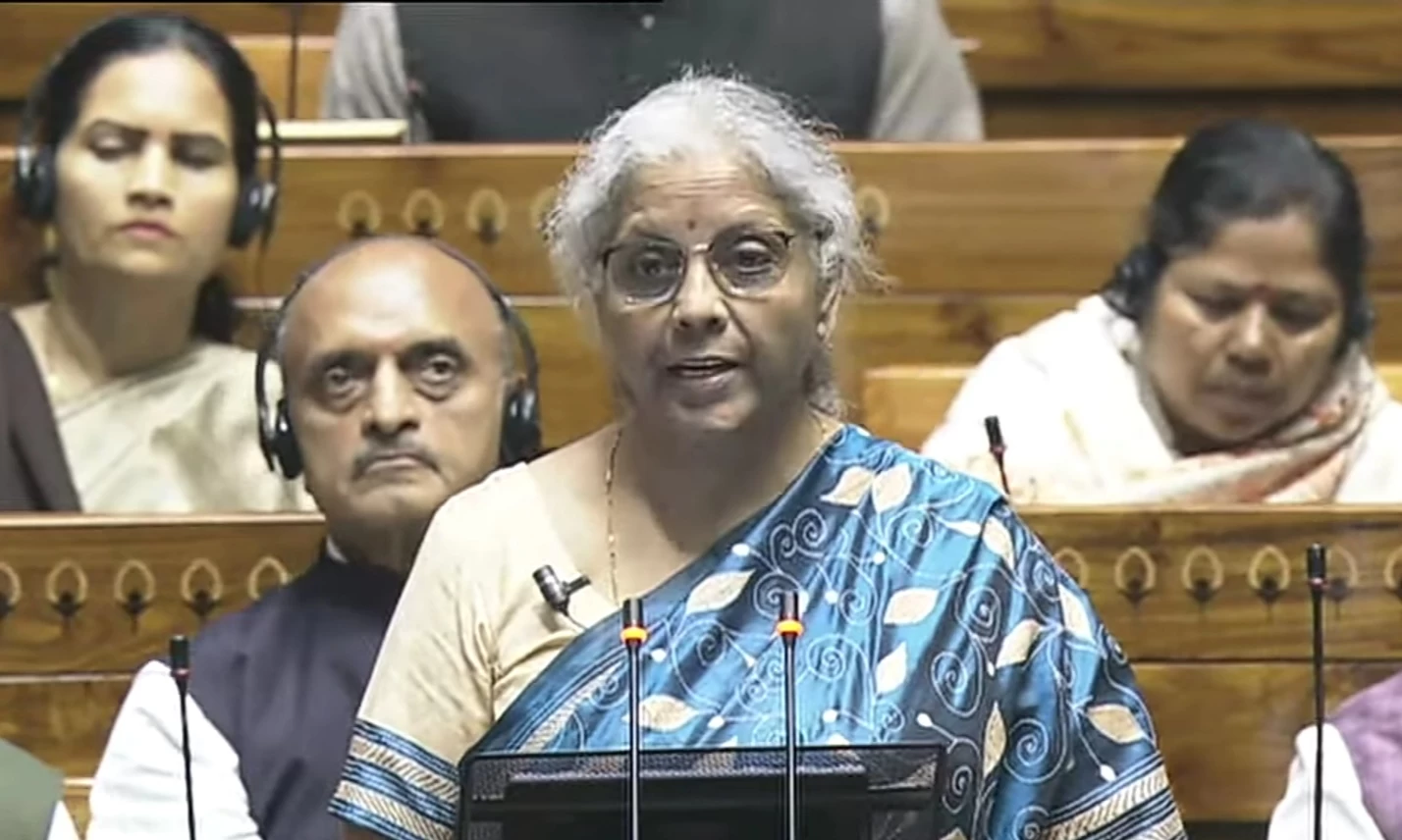

Finance Minister Nirmala Sitaraman presented the Interim Budget 2024-25 in the Parliament on Thursday. The finance minister made no alterations to the tax rates, for both direct and indirect taxes, including import duties. In addition, she noted that the government aims to persist in its fiscal consolidation, aiming to decrease the fiscal deficit by 2025-26.

In her speech, the Finance Minister noted that India has experienced a postive growth in the last decade. Sitaraman stated that the government aspires to attain comprehensive, widespread, and inclusive development by concentrating on the empowerment of marginalized groups, including the economically disadvantaged, women, youth, and farmers, with the goal of fostering holistic progress and societal well-being.

The budget has laid out a multifaceted approach aimed towards economic management encompassing infrastructural enhancement, development of digital public infrastructure, and reforms in taxation. The projected fiscal deficit for 2023-24 is revised to 5.8% of the GDP, with an objective to bring it down to less than 4.5% by the fiscal year 2025-26.

In the interim Budget 2024, the finance minister has maintained status quo on tax rates, including import duties. However, she announced benefits for start-ups and tax exemptions for the International Financial Services Centre (IFSC) units that were initially set to expire in March, would now be prolonged until March 2025.

In the last budget of the Narendra Modi government, ahead of the all-important 2024 Lok Sabha elections, the Finance Minister pledged the government's commitment towards the inclusive economic growth, stability, global positioning, sector-specific advancements, environmental sustainability, and tax reforms.